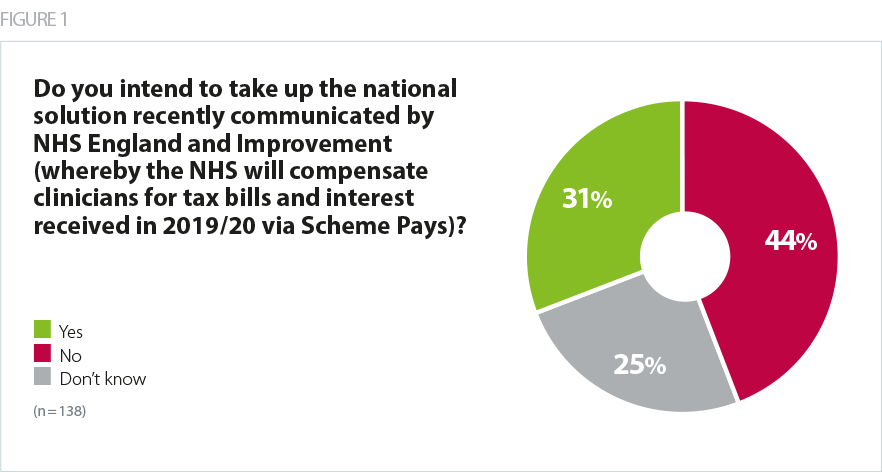

A minority of clinically qualified directors (31%) intend to take up the proposed solution reimbursing clinicians for tax bills incurred in 2019/20. Just under half (44%) said they did not intend to take up the solution and around a quarter didn't know.

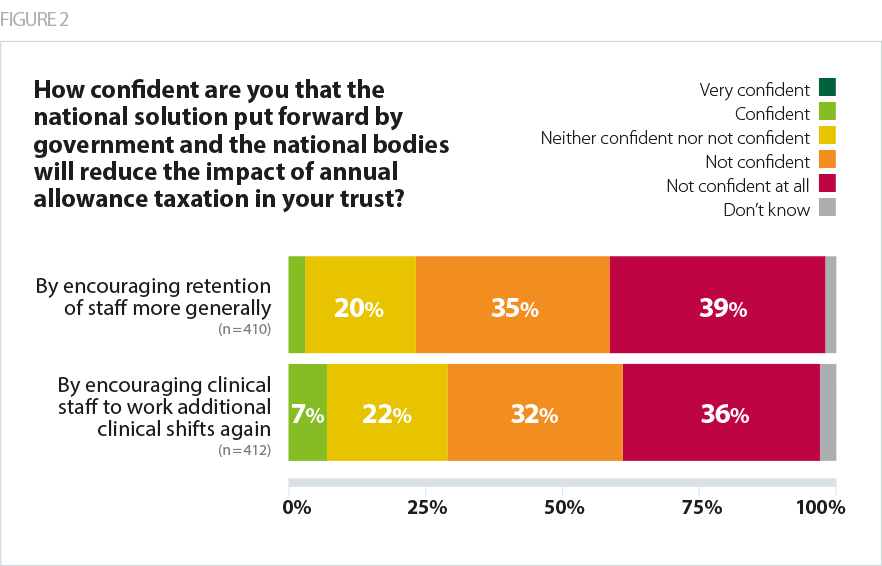

There is a widespread view among respondents that the policy being implemented for 2019/20 tax liabilities, as well as future flexibilities designed to mitigate the risk of senior clinicians receiving tax bills related to pension contributions, are unlikely to lead to senior clinicians taking up additional shifts that they had dropped, or support retention of clinicians more generally in the NHS.

Just 7% of respondents felt confident that the national solution would encourage clinical staff to work additional clinical shifts again, and 3% were confident that it would encourage the retention of staff more generally. Doctors working in challenging roles in overstretched services have, in the words of one respondent, made a lifestyle decision to achieve a different work/life balance in the context of the pensions taxation issue, which they are now reluctant to give up even when financial risk is removed.

Trust leaders described a lack of trust among their senior clinical staff in the most recent policy offered up by the government, despite assurances that the policy would be honoured at retirement regardless of the time elapsed. This may be due to the cumulative effect of the issue over a period of months and the consequent erosion of trust among senior clinicians in the NHS. This is coupled with the perceived divisiveness of the new scheme, which differentiates between different groups of staff involved in delivering the same services, whether that is frontline care or the leadership which supports clinicians to deliver that frontline care.