The secondary care acute sector comprises of acute, specialist acute and combined trusts delivering urgent and emergency care, planned care and specialised care for different conditions such as rare cancers, genetic disorders or complex medical or surgical conditions. It isn’t possible to cover the data associated with all acute pathways here. For the purposes of this summary, we explore the trends across A&E services, diagnostics, the elective care waiting list and cancer services. We also look at data relating to current levels of NHS capacity such as general and acute beds and metrics of patient flow.

Demand and activity

Demand for urgent and emergency care has been extremely high and therefore activity has followed suit. This has been the busiest year ever, with the first six months of the year seeing record highs for each month in terms of A&E attendances. June recorded 2.3 million A&E attendances. This is 3.3% more than June 2023 and 8.8% greater than five years ago in June 2019, before the pandemic. Similarly, emergency admissions also recorded the busiest June on record with nearly 537,000 emergency admissions, 1.5% higher than five years ago.

A&E Emergency admissions

For planned care, demand continues to push a stretched system with existing backlogs. However, the increase in activity is often overlooked by the waiting list data. The latest data for May 2024 shows that over 2.4 million diagnostic tests were carried out - over 91,000 more than the month before and the highest number of tests ever recorded. This is nearly 11% higher than a year ago and 21% higher than pre-pandemic levels in May 2019.

Diagnostic tests have been consistently reaching record monthly levels since October 2023 (with the exception of March 2024). The number of MRI, CT and colonoscopy scans have all increased, up by 11.7%, 9.6% and 0.1% respectively compared to last year. Compared to May 2019, these tests have increased by 28.1%, 38.6% and 22.7%, respectively.

Diagnostic tests

Demand for elective care continues to rise. There were 1.79 million new RTT pathways in May, an increase of 5% on April, but activity increased this month. The number of admitted inpatient treatments or day cases increased by 0.8% compared to April, reaching nearly 313,000 in May. The number of non-admitted pathways rose further comparatively, increasing by 3.3% on the previous month – an additional 39,000 pathways.

Lastly, cancer services activity also increased. In May, the number of patients completing the 28-day faster diagnosis pathway increased by 9,000 (3.4%) to 273,800. This is the second highest month on record. The number completed within the standard increased by 14,600, boosting performance against the standard. Activity across the 31-day and 62-day pathways also increased since last month, by 2.6% and 3.3% respectively.

Waiting times

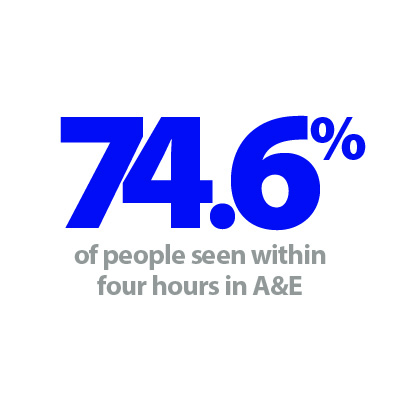

During the election campaign the Labour party promised that by the end of their term the NHS will return to meeting the constitutional standard that 95% of people who attend A&E will be seen within four hours. There is currently a significant gap between this ambition and current levels of performance.

A recovery target was set out in the planning guidance for 2024/25, requiring trusts to see 78% of patients in four hours by March 2025. In June 2024, performance against this target improved ever so slightly to 74.6%. Of the 121 trusts with a type 1 A&E department, five are currently meeting the 78% recovery target. The review of operational performance by Lord Darzi will no doubt cover this issue.

The number of patients waiting more than 12 hours from the decision to admit to admission decreased by 4,500 from the previous month, reaching 38,100. This figure is 43.6% greater than June last year. Five years ago, before the pandemic, only 471 people waited more than 12 hours. This metric, alongside handover delays and delayed discharge acts as a key indicator in terms of pressure across the whole health and care system.

In relation to waiting times for planned care, the diagnostic waiting list increased slightly this month by 1.4% to 1.66 million. Compared to last year, the waiting list has increased by 4.7% and, compared to May 2019, has increased by 56.5%. Over a fifth (22%) of patients waited six weeks or more for a test, an improvement from 23% last month, but missing the 5% target set out in the 24/25 planning guidance. There were 157 trusts reporting diagnostic waiting lists this month. 30 of these trusts met or exceeded the target to see 95% of patients within six weeks or less. There is significant variation across diagnostic waiting lists. The longest waits from 37 of the 157 trusts contributed to half of the total waiting list.

The elective care waiting list increased for the second month in a row after falling for the previous six months. Now at 7.6 million, the waiting list increased by around 30,00 in May. The size of the waiting list is 1.8% greater than it was a year ago and 69% greater than five years ago. In May, 83.9% of patients on the waiting list were unique patients. This is an estimated 6.38 million people, an increase of 50,000 on the previous month.

There was a slight improvement in the numbers of treatments waiting >78 weeks and >104 weeks compared to last month, falling to 4,600 and 259 treatments, respectively. The target in the 2024/25 operational planning guidance is for no patients to be waiting longer than 65 weeks by September 2024. However, treatments waiting over 52 and 65 weeks both increased. Despite the growth here, the total number waiting more than 18 weeks actually decreased by over 51,000. This is testament to the increase in activity and resulted in an improvement against the 18-week standard, albeit small. At the end of May, nearly 60% of treatments had been on the waiting list less than 18 weeks and the remaining 40% (3.1 million treatments) have waited more than 18 weeks.

There is, of course, trust variation and speciality variation across the waiting list. Size of trust will play some role here. The 14 trusts with the most incomplete treatments all have over 100,000 treatments on their waiting list, with the highest reaching nearly 190,000. In relation to long waiters, of the 131 trusts that currently have incomplete pathways of over 65 weeks, the top 10 trusts account for nearly 40% of waits.

The cancer standards have been streamlined recently into three new targets: Faster Diagnosis Standard (FDS) 28-day referral, 75%; 31-day treatment standard, 96%; 62-day treatment standard, 70%. Performance against the 28-day faster diagnosis standard was met this month (76.4%); performance for the 31-day also improved but did not meet the standard (91.8%), while performance on the 62-day pathways deteriorated and did not meet the standard (65.8%). 91 out of 132 acute trusts reporting this month met the 28-FDS target.

The improvement in performance against the 28-day FDS target improved, with those being told if they had cancer, or if cancer was definitively excluded within four weeks. This is a positive move towards the new target of 77% set out in the planning guidance for 2024/25.

Capacity

As part of the delivery plan for recovering urgent and emergency care services, NHSE promised additional beds to help deal with increasing pressures on hospitals. In the plan they acknowledge the well-established link between high bed occupancy rates in hospitals and worse A&E performance and set out an objective to return bed occupancy to 92%. In June 2024, there were 101,300 general and acute (G&A) beds available and the bed occupancy rate was 92.8%, down from 93.2% in May.

Patient flow around the health and care system remains a systemic issue across the country. For hospitals, delayed discharge is a daily focus and challenge. On 30 June (a Sunday), there were 18,000 patients who no longer met the criteria to reside in hospital. Of these, 68% remained in hospital that day. On average in June, there were 22,000 patients who no longer met the criteria to reside and of these 55.4% remained in hospital each day.